The Best Solar Panels For Sale

As people become more and more environmentally conscious, they are searching for ways to reduce their carbon footprints. One of the most effective ways to do this is by getting solar panels. Not only are they an eco-friendly way to generate power, but they can also save you money in the long run. With so many different solar panels on the market, it can be difficult to know which one is the best for your needs. That’s where we come in! We’ve done the research and found the best solar panels for sale.

The Top 5 Best Solar Panel Companies

What Are Solar Panels And How Do They Work?

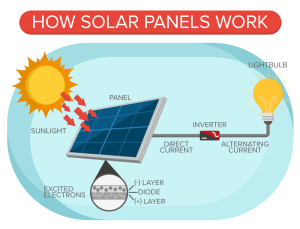

Solar panels are a great way to save money on your electric bill and help the environment. But what are solar panels and how do they work?

Solar panels are made up of photovoltaic cells, or PV cells. These cells convert sunlight into electricity. The more PV cells there are in a solar panel, the more electricity it can generate.

PV cells work by having electrons that flow through them when they are exposed to sunlight. This flow of electrons creates an electric current that can be used to power appliances and lights.

Solar panels are usually made from silicon, which is a material that is very good at absorbing sunlight. The silicon is then combined with other materials, such as metals, to create the PV cells.

Solar panels can be used to power homes, businesses, off grid cabins, cars & much more! They are becoming increasingly popular as people look for ways to save money on their electric bills and help the environment.

If you are interested in buying solar panels, there are a few things you should keep in mind. First, solar panels can be quite expensive. However, there are many ways to finance them, such as through government incentives or solar leasing programs.

Second, they require a sunny location in order to work well. If the place you want to set up your panels at is not located in an area that gets a lot of sun, you may not be able to generate enough electricity to power your entire setup.

Finally, the best solar panels can last for many years, but they will eventually need to be replaced. When choosing solar panels, be sure to select a quality product that will last. You can ensure you are getting the best solar panels by using one of the reviewed solar panel companies above.

The Benefits Of Using Solar Panels

The benefits of using the best solar panels for sale are many. They can help save on energy costs, they are environmentally friendly, and they can provide a source of backup power in case of an electrical outage. They are becoming increasingly popular as people look for ways to save money and be more environmentally conscious. Here are some key benefits of solar panel usage:

1. Solar panels can help save on energy costs.

They can help offset electricity costs by generating renewable energy that can be used to power your home or business. In some cases, home owners may even be eligible for government incentives or rebates.

2. They are environmentally friendly.

They do not produce harmful emissions or pollutants, making them a clean and renewable source of energy. Additionally, they can help reduce your carbon footprint and do not require water for operation, unlike traditional power sources such as coal or natural gas.

3. They can provide a source of backup power.

In the event of a power outage, they can provide a reliable source of backup power. This is especially beneficial for businesses that cannot afford to lose power or operate without electricity for extended periods of time. Additionally, solar panel systems can be designed to provide power during a grid outage or natural disaster.

4. They have a long lifespan.

They are built to last and can provide years of reliable energy generation. With proper maintenance, they can last 25 years or more.

5. They are low maintenance.

They do not require much upkeep and are typically maintenance-free. In most cases, the only required maintenance is an annual cleaning to remove dirt, dust, and debris that may accumulate on the panels.

6. They are very versatile.

They can be used for a variety of applications, including powering homes, businesses, portable electronics, and even vehicles. Additionally, they can be used in a variety of climates and weather conditions.

7. They are increasingly affordable.

Thanks to advances in technology and manufacturing, they are more affordable than ever before. In many cases, the initial cost of installation can be offset by energy savings within a few years.

8. They have a minimal impact on the environment.

They have a very small footprint and do not require water or other resources for operation. Additionally, solar panel systems can be designed to blend in with their surroundings, making them virtually invisible.

9. Solar panels are becoming more efficient.

As technology advances, solar panels are becoming more efficient at converting sunlight into electricity. This means that fewer panels are needed to generate the same amount of power, which can save money and space.

10. They offer a renewable source of energy.

The best solar panels rely on sunlight to generate electricity, making them a renewable source of energy. This is in contrast to fossil fuels, which are finite resources that will eventually be depleted.

How Much Money Can I Save With Solar Panels?

Solar panels are becoming a more and more popular way to save on energy costs, and with good reason. By using them, you can save a lot of money on your energy bill.

How much money can you save by using the best solar panels? That depends on how big your solar panel system is, and how much energy you use. A typical basic solar panel system can save you around $100 to $200 per month on your energy bill. So over the course of a year, you can save around $1200 to $2400.

That’s a lot of money! And over the lifetime of your solar panel system, you can save tens of thousands of dollars. So if you’re looking for a way to save money on your energy costs, solar panels for sale are a great option.

The Future Is Solar

As you can see, there are a lot of factors to consider when it comes time to buy solar panels. It’s important to do your research and find the best solar panels for your needs and budget. Luckily, we’ve done some of the hard work for you and compiled a list of the best solar panels for sale on the market right now. We hope this information was helpful and that you feel confident in making an informed purchase decision on solar panels. If you have any questions, don’t hesitate to reach out to us – we would be happy to help!

-The AquillaSolar Team